Become a Member

BFCU's mission is to serve the community of member - owners by providing diverse, competitive and progressive financial services to improve the financial well being of our members and their families. We provide our members an alternative way of banking, one where people are more important than money and a credit score doesn't define you. We offer products and services that are designed to save members money - many of which are FREE.

When it comes to accessing your financial institution, we offer the same convenient banking tools to access your money anytime, anywhere, such as BFCULive Online Banking and our ‘BorderFCU Mobile’ app. Plus, we are local, so when you have a question or issue, you can talk with someone right here in our community. Local. Trusted. Owned by YOU!

Membership Requirements

-

Eligibility

- Immediate Family Member of an Existing BFCU Member

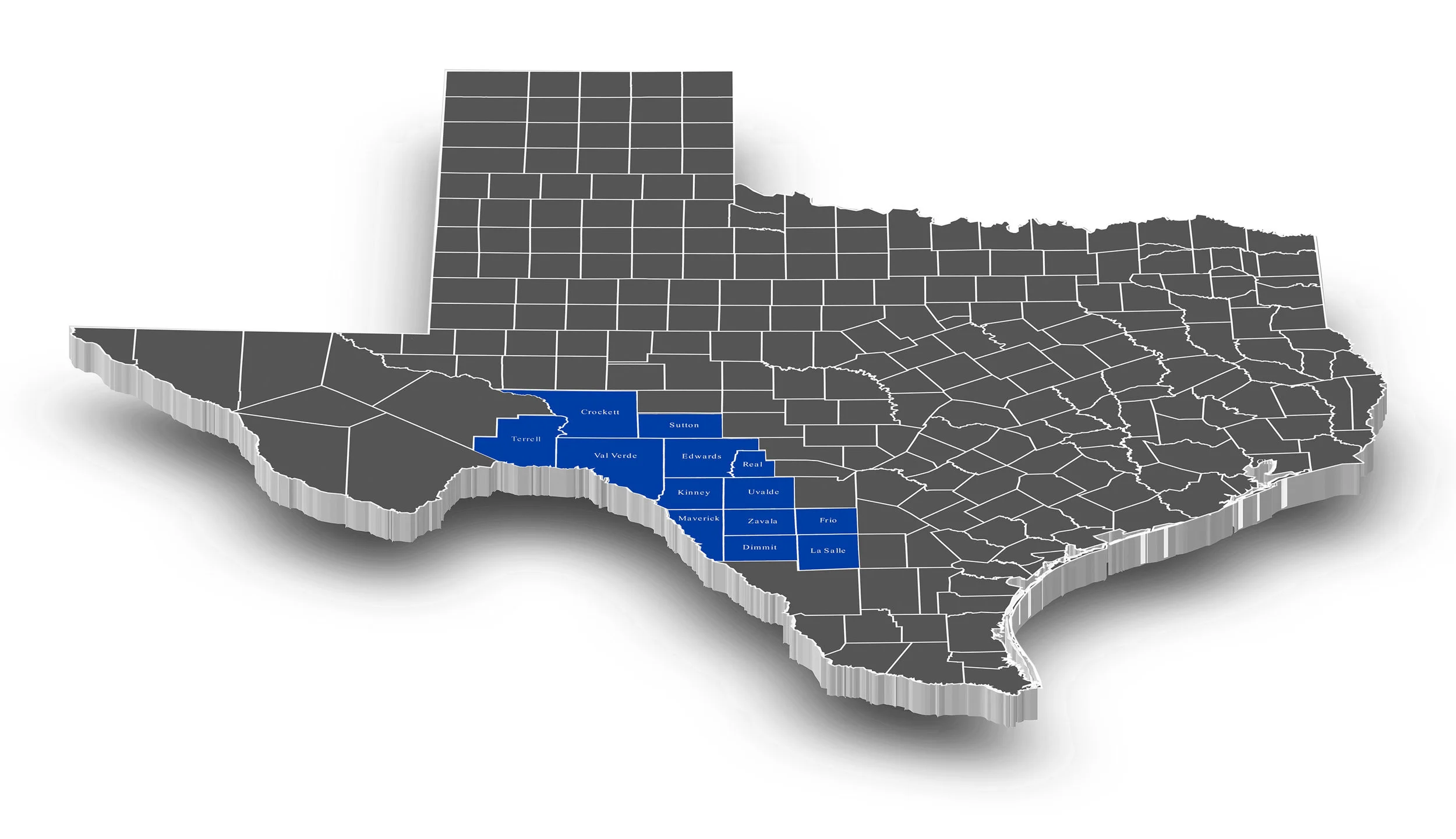

- Reside, Work, Worship or Attend School in the Qualifying 13 Counties

- Qualifying Counties: Crockett, Dimmit, Edwards, Frio, Kinney, LaSalle, Maverick, Real, Sutton, Terrell, Uvalde, Val Verde & Zavala

- Valid Picture ID and Social Security Card

To become a member of Border FCU, you must first qualify for membership. If you meet our eligibility requirements, you then can join our credit union family. Please bring your valid driver's license, US Passport, or other government issued ID along with your social security card and the required minimum $5.00 to open your membership and share account.

IMPORTANT: If the address on your driver's license is not your current PHYSICAL address, such as a PO Box or your previous address, you must bring proof of residence that has your name and current physical address on it or acquire an updated driver's license or ID from DPS. -

Acceptable Forms of Proof of Residence

- Utility Bill

- Lease Agreement from Renters

- Employment Contract/Payroll Verification

- Military Orders

To help the government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act, a Federal Law, requires all financial institutions to obtain, verify, and record information identifying each person who opens an account, including business accounts.

What this means for you: When you open an account, we will ask for your name, address, date of birth and other information allowing us to identify you. We may also ask to see your driver's license or other identifying documents. If you are opening an account on behalf of a business entity, documents relating to the business may also be requested.

Additionally, FinCEN has adopted what they describe as a "two pronged" approach to beneficial ownership. The ownership prong includes all natural persons with 25% or more direct or indirect equity interest in a legal entity while the control prong is a single individual with significant managerial responsibility (the Rule says "control, manage, or direct") over the legal entity. We will ask to see each person's driver's license and other identifying documents, and copy or record information from each of them.

Service Areas

Serving residents of Crockett, Terrell, Val Verde, Sutton, Edwards, Real, Kinney, Uvalde, Maverick, Zavala, Dimmit, Frio and La Salle counties.

Share Account (Savings)

A share account is a savings account required for membership. A member must open a savings account with a minimum deposit of $5.00 in order to take advantage of all the convenient and great products and services Border FCU has to offer. A minimum average balance of $500.00 in your savings account is required to obtain the disclosed annual percentage yield.

Investing in Educators!

August 1 – October 17, 2025

This August and September, Border FCU is celebrating the incredible impact of educators in our community. Whether you're in the classroom, the library, or leading a school program, we appreciate you!

As a thank-you, we’re covering the $5 membership deposit for teachers who join Border FCU during this time.

Who qualifies?

Active educators who meet membership eligibility

Valid teacher ID or proof of employment required

Offer applies to new Regular Share Accounts only. No cash value.